AI is moving fast. Many lenders are not.

Security is non-negotiable. The learning curve is steep. Not everyone is on board. There is fear. This is new for compliance and regulators, too.

(So please be nice to them!)

Throughout 2025, BankersLab partnered with clients to apply AI-driven simulations to real-world lending challenges. These predictions reflect lessons from those engagements and from our work with industry partners.

Here’s what we think will actually change next year for retail bankers and lending—and how to act while sidestepping the hype.

1) “Private AI” becomes the default—not a nice-to-have

What you’ll feel: Your sensitive data and models run inside your walls (or a locked-down private cloud). Risk, credit, and customer-facing teams will only green-light tools that meet that bar.

The hard truth: “Private” doesn’t mean “safe.” You can still end up over-dependent on one vendor, with opaque model updates and audit gaps.

Do this now:

-

Make “no public data egress” a contract clause.

-

Log who used which model, on what data, and why a decision was made.

-

Negotiate exit ramps—portable prompts, portable embeddings, portable data.

See the future. Shape the outcome. Learn how our AI-powered simulations can drive your 2026 lending performance.

2) Targeted wins beat grand plans—because your P&L is tired of waiting

What you’ll feel: Small, sharp use cases finally stick: delinquency outreach that actually collects, fraud alert triage that cuts noise, frontline assistants that end calls faster and happier.

The hard truth: Big “AI transformation” programs will keep dying in pilot purgatory. Time saved doesn’t equal money saved unless you redesign the work.

Do this now:

-

Pick 3–5 use cases with 12-week pilots and a single success metric each (e.g., dollars collected per contact, false-positive rate, average handle time).

-

Pre-commit to how you’ll bank the benefit (shrink queues, reassign work, reduce overtime).

3) The workforce splits: power users vs. everyone else

What you’ll feel: A visible cohort becomes scary-productive with vetted AI tools. They know the shortcuts, the prompts, and the controls. Everyone else watches.

The hard truth: If you don’t create tiers of access and training, you’ll get shadow tools, uneven quality, and audit headaches.

Do this now:

-

Launch a “Power User Program” with selection criteria, training hours, and KPIs.

-

Give power users the better tools first—and hold them to measurable outcomes.

-

Create a new function—call it “agent ops”—to own prompt libraries, testing, and rollout.

4) Governance moves from paper to daily habit

What you’ll feel: Reason codes, bias checks, vendor logs, and model change logs become routine. Not annual exercises—weekly ones. Supervisors will ask for them.

The hard truth: Compliance theater will get called out. If you can’t show lineage (which model, which data, which version), you’ll pause or unwind launches.

Do this now:

-

Keep a living model inventory and a simple, shared change log.

-

Treat third-party models like critical vendors: resilience testing, concentration risk, kill switches.

-

Put humans in the loop where harm is real (credit decisions, fraud denies, collections scripts).

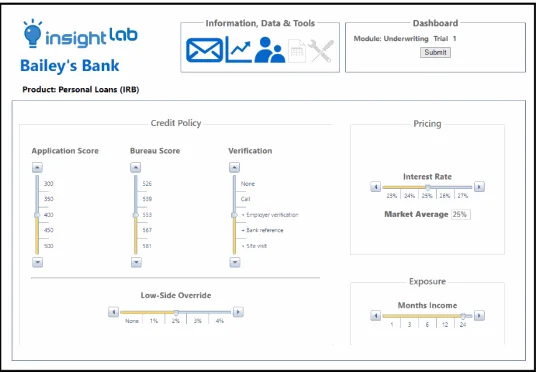

5) From dashboards to decisions: simulate before you ship with BankersLab and InsightLab Simulations

What you’ll feel: Before changing pricing, credit policy, or campaign spend, teams run “test-before-deploy” simulations to estimate roll-rate, churn, and P&L impact—then pilot only the winners.

The hard truth: If they aren’t back-tested against history and monitored in production, they will mislead you.

Do this now:

-

Make simulation a gate in your change process for pricing, underwriting, and collections capacity.

-

Back-test against old vintages; require confidence bands and failure cases.

-

Pilot narrowly, measure ruthlessly, and promote only what beats current policy.

Your 2026 Checklist

- Security first: Private deployment, no data egress, full decision traceability.

- Short list of wins: 3–5 targeted use cases with 12-week clocks and one metric that hits the P&L.

- People plan: Power User Program + “agent ops” to industrialize how AI gets built, tested, and rolled out.

- Everyday governance: Inventory, reason codes, bias checks, vendor logs, change logs.

- Decide with simulation: Test policy changes in a sandbox, pilot the winners, retire the rest.